The Thredd team

December 17, 2025

How fintechs can identify international growth opportunities that align with capability and compliance.

The Thredd team

Expanding internationally is one of the most powerful growth levers for fintechs and programme managers. Success depends on more than ambition; it requires strategic discipline, local insight, and the right partnerships.

Expanding into new markets gives fintechs the chance to diversify revenue, build resilience, and reach new customer segments. A well-executed global expansion strategy can increase brand recognition and investor confidence while opening access to cross-border clients.

However, international growth also introduces new layers of complexity. Local regulation, infrastructure constraints, and cultural differences can all influence execution. The most successful fintechs take a measured, fact-based approach that weighs market potential against operational readiness.

Rapid growth in a core region can be a strong signal that the business is ready to scale internationally. Investors often view multi-market presence as a marker of maturity. Yet growth should never be pursued for visibility alone.

Before entering a new territory, fintechs must evaluate market opportunity and ease of execution. The central question is whether existing platforms and partnerships can scale without disproportionate reinvestment.

API-driven and modular infrastructures are naturally suited to cross-border replication. In contrast, products reliant on specific local licences or one-off integrations may struggle to adapt. Sustainable expansion favours platforms built for interoperability, not customisation.

Market demand is rarely consistent across geographies. In many cases, expansion begins with client pull-through—existing customers requesting the same level of service in new regions. For instance, a European corporate disbursement client might expect identical card functionality in the United States or Asia-Pacific.

The partner ecosystem is just as important. BIN sponsors, processors, and network partners form the backbone of early-stage market entry. A strong compliance reputation and proven delivery record in regulated markets can help fintechs secure these relationships faster.

For brands still building recognition, demonstrating credibility through robust governance and operational resilience can help open doors. Partner confidence is often the deciding factor between rapid market entry and long delays.

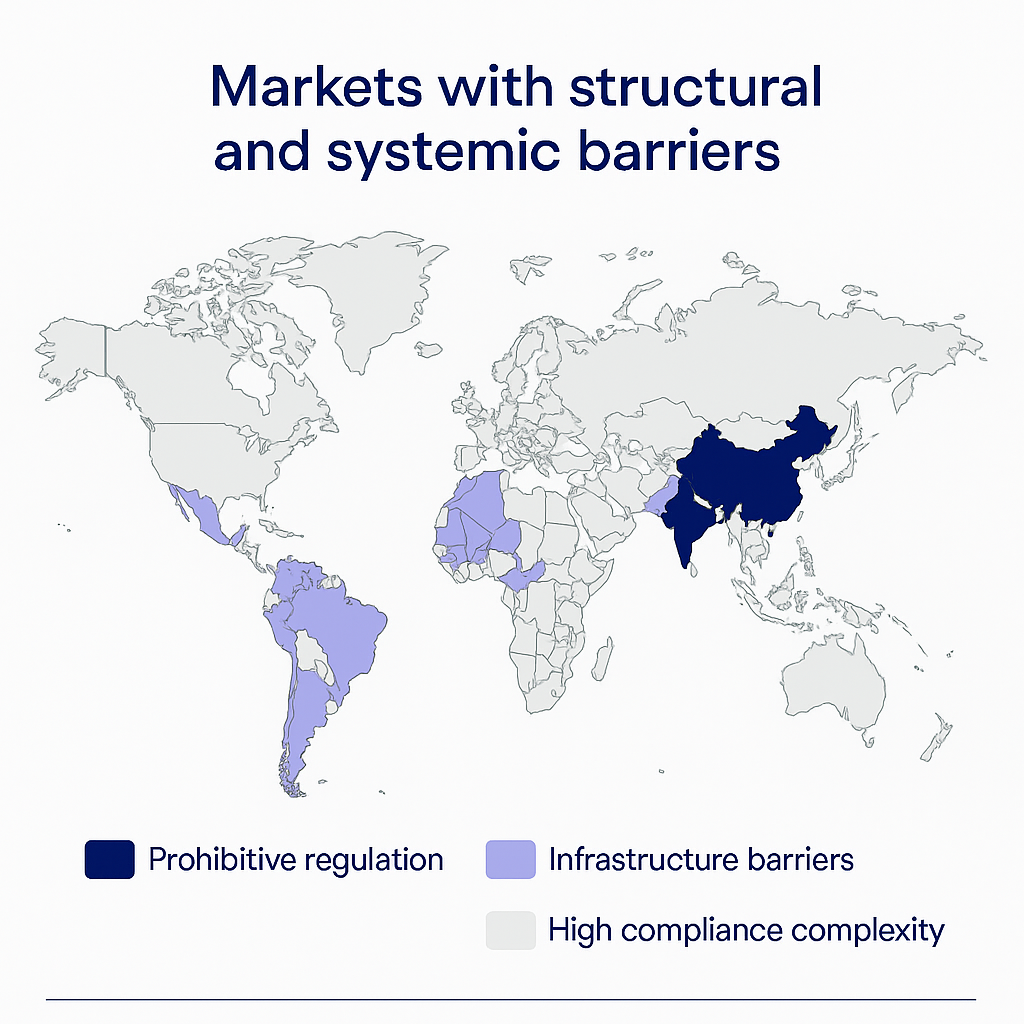

A disciplined global expansion strategy recognises both green lights and red flags. Some markets are best avoided due to structural barriers or systemic risk.

Structural barriers include:

Highly developed national infrastructures, such as India’s UPI or Aadhaar, that leave limited room for external players unless they offer genuine differentiation.

Closed or restricted banking systems, common in parts of Latin America, that limit foreign access through local clearing arrangements.

Systemic risks include:

Markets with persistent corruption or low regulatory transparency, where the risk of loss or reputational damage is high.

Jurisdictions prone to abrupt policy shifts, which can disrupt operations or block capital flows.

Attempting to expand without trusted local partners adds further risk. Local expertise helps fintechs navigate certification, taxation, and regulatory frameworks efficiently, saving time and avoiding costly missteps.

Even where demand appears strong, the economics or compliance burden may prove prohibitive. Knowing when to walk away is a hallmark of operational maturity.

Fintechs expanding internationally should evaluate each target market against consistent, data-driven criteria. A practical market scorecard might include:

Total addressable market and growth rate

Product-market fit (consumer, SME, or corporate)

Existing customer or partner demand

Readiness of local payment rails and technology infrastructure

Regulatory openness and predictability

Political stability and ease of doing business

FX volatility and profit repatriation policies

This structured comparison allows leadership teams to see where opportunities outweigh risks. It also highlights where entry costs or policy instability could undermine long-term returns.

Effective frameworks look beyond the immediate potential to assess five-year outlooks. Some markets require heavy upfront investment with slow revenue ramp-up or limited capital mobility. Without this foresight, even strong short-term metrics can lead to unsustainable operations.

Global expansion is not a race to cover more maps. It is a process of matching the right proposition to the right environment.

Key principles include:

Aligning expansion timing with platform capability.

Following genuine demand from existing clients.

Building relationships with compliant local partners early.

Avoiding markets with systemic or regulatory instability.

Weighing economics and governance as heavily as demand.

Fintechs that combine strategic patience with operational agility are the ones that convert expansion into sustainable growth. Entering a new market is not success in itself; scaling compliantly and profitably within that market is.

Globalisation remains one of the most powerful growth levers in payments. It is also one of the toughest tests of resilience. The fintechs that win internationally are not those that move first but those that move wisely—aligning opportunity with execution and understanding when to pause.

A collaborative report with B4B Payments, providing data-driven insights and proven frameworks for market expansion success.

Sign up to receive Industry news, events and insights delivered straight to your inbox.