Customers expect instant decisions, personalised limits, and seamless digital experiences. But most issuers still rely on fragmented systems with separate vendors for origination, servicing, processing, and collections.

Every handoff creates delays and reconciliation errors. Every integration point becomes a blind spot that limits speed and scale.

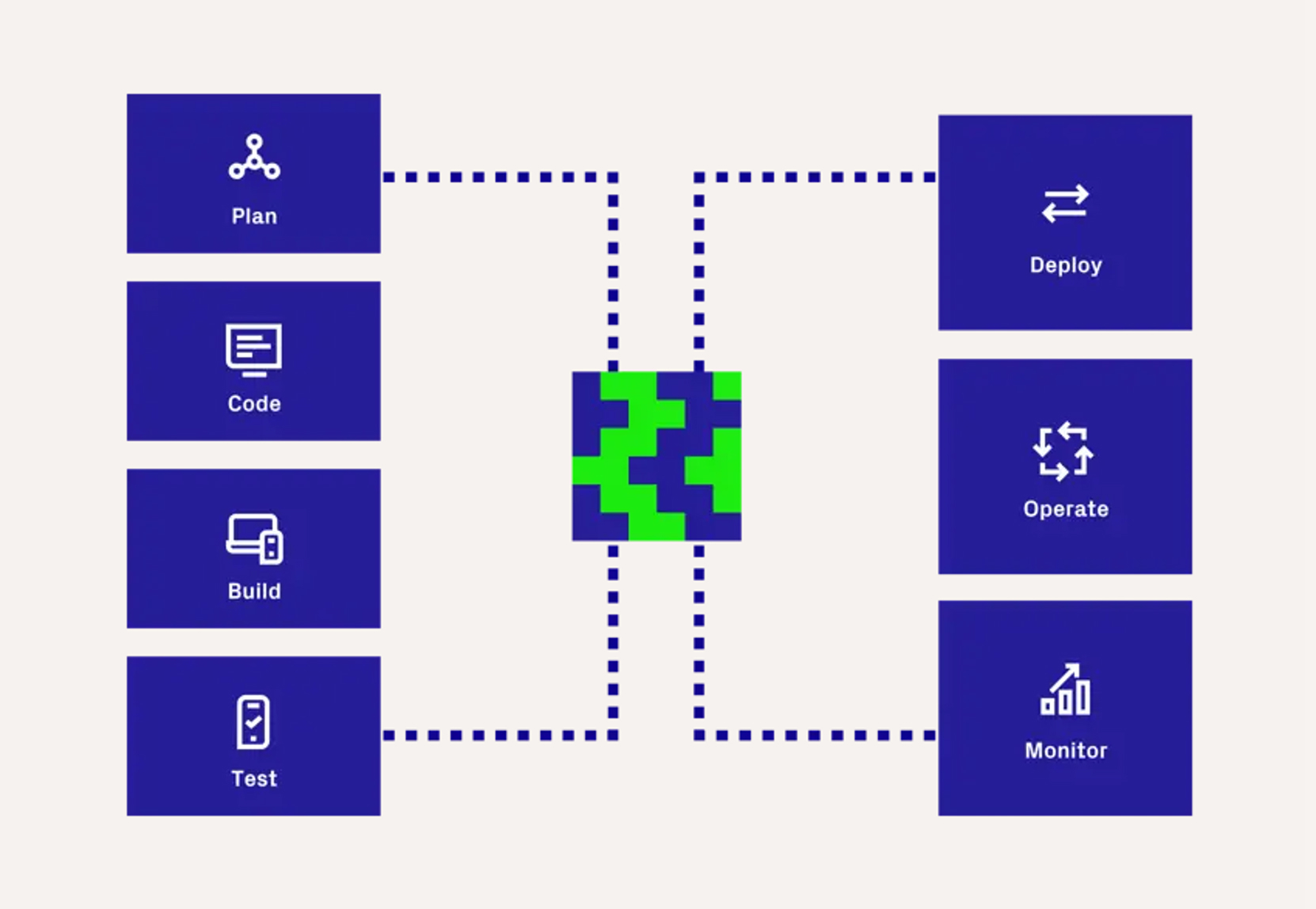

We've built a unified, AI-powered platform that connects credit intelligence with payment infrastructure. From origination to repayment, everything runs on a single ledger that adapts with every transaction.

Leave traditional timelines behind. Launch at modern speed

Power any product — secured, revolving and BNPL

Built-in compliance, and global scalability without compromise

This isn't just credit processing. It’s intelligent credit infrastructure.

Design and deploy credit programs fast using configurable templates and pre-integrated bureau, KYC, and open-banking connections.

AI models learn from transactions, not just applications. Our engine adapts credit limits, pricing, and risk scoring as behaviour evolves — enabling smarter approvals and reduced losses.

Automate account management, billing, and collections with audit-ready workflows and dynamic spending controls.

Flexible credit constructs

Support secured, revolving and BNPL. From consumer credit cards to commercial lines, Thredd handles the full spectrum on one configurable platform.

Transaction-level intelligence

We don’t approve credit once and apply static rules. Thredd adapts with every transaction, refining limits, pricing, and risk controls in real time.

Embedded experiences

Enable contextual credit inside digital wallets, consumer platforms, and business tools. Make credit feel natural within the user journey — not as a separate application process.

Single platform connecting origination, servicing, and collections. Eliminating vendor sprawl and reconciliation headaches

AI-driven decisioning that adapts throughout the customer lifecycle, not just at approval

Transaction-aware processing that turns every purchase into an opportunity to optimise credit performance

Multi-market readiness with partner integrations and scheme certifications across major global networks

Whether you're launching your first credit product or scaling a multi-market portfolio, we're here to help you move fast, scale smart, and deliver standout experiences.