Merchant acquirers vs. payment processors Merchant acquirers vs. payment processors

What’s the difference?

What’s the difference?

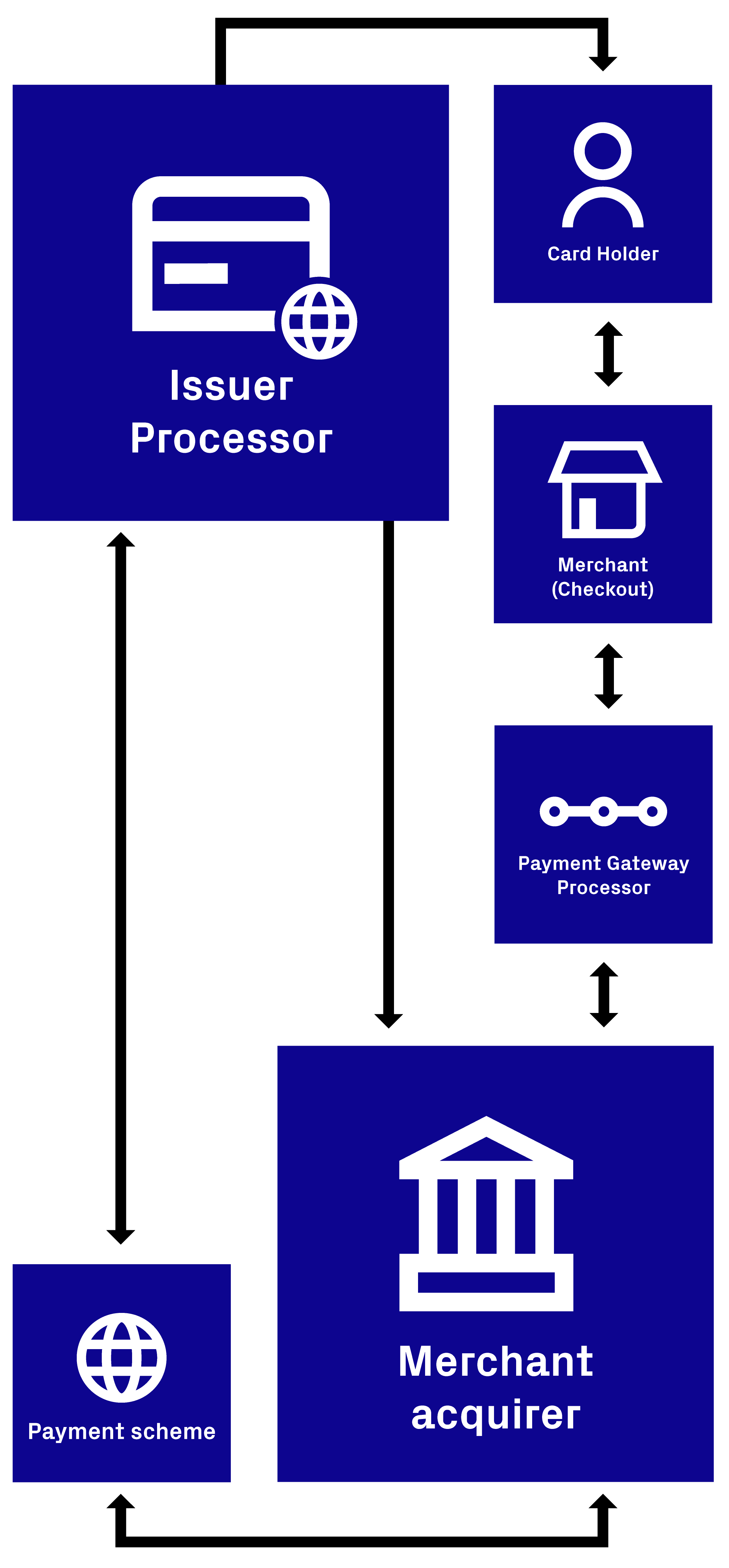

Payment processors like Thredd are the heart of the payments process. They do a lot of the hard work, shuttling data between various financial players and authorising transactions.

But they’re not the only players on the payments pitch. Here, we explain the difference between payment processors and merchant acquirers, and how they each fit into the wider payments ecosystem. For more information on some of these terms, visit our Glossary.

A merchant acquirer, acquiring bank, or simply, ‘acquirer’ is a bank or financial institution that accepts card transactions on behalf of a merchant.

They allow merchants to accept and process card payments from card-issuing banks within a card association or scheme such as Visa or Mastercard.

The acquirer arranges the transaction, crediting the merchant’s bank with the correct amount, and essentially acting as a payment facilitator that takes responsibility for the payment. They also deal with any disputes raised from card issuers towards their merchant’s transactions.

Simply put, a payment processor… processes payments. They’re the tech companies that authorise and carry out transactions on behalf of the issuing or acquiring bank.

It’s not quite that simple, though. There are, in fact, two kinds of payments processor:

They both have to comply with card associations’ rules and regs, putting various security and fraud protection measures in place, to make sure every transaction is as safe as possible.

The payment gateway is a network that acts as the payments’ middleman. It’s the technology that reads payment cards, forwarding customer information from the processor to the merchant to complete a transaction.

It’s the acquiring payment processor, not the issuer processor, which allows merchants to accept card payments via a payment gateway, either through an ecommerce website or face-to-face via a card terminal.

It can be easy to confuse the merchant acquirer and payment processor, but they’re very different entities, each with an important part to play.

One way to differentiate them is to think of a payment processor as the technical arm of an acquirer: providing technology, authorising transactions, and potentially receiving settlement information.

Payment processors work directly with merchants, obtaining and processing card information for transactions, whereas acquiring banks work and mediate between card networks, including the issuing bank and the merchant. Processors manage technical merchant services such as the process of moving funds, but the financial liability stays with acquiring banks.

While some financial institutions can be both the merchant acquirer and the processor, since the fintech boom there’s been a move towards using separate, third-party processors.

Having these two different but complementary providers makes it easier to create customised payments experiences to suit almost any use case. Your issuer processing partner will help you connect all the dots, and launch and scale your programme seamlessly.If you want to find out more about how the payments process works, read our article on navigating the payments ecosystem.

Sign up to receive Industry news, events and insights delivered straight to your inbox.