People need to pay for things, and people need to get paid. It’s the payments industry that makes it happen. Simply, seamlessly, and instantaneously.

The payments ecosystem is founded on confidence and trust, with every part working together to keep the world’s transactions running smoothly. And it’s Thredd’s invisible payments magic that connects all these constantly moving parts.

The industry’s growing at an astounding rate: according to a study by McKinsey [1], it made over $2.1 trillion globally in 2021, and will top $3 trillion by 2026. Meaning that there are almost limitless opportunities to make a big splash in the payments pool.

It’s an exciting network to be a part of, but with so many elements involved it can get quite complex. Here, we introduce you to some of the most important players, and explain their role in the wider payments ecosystem.

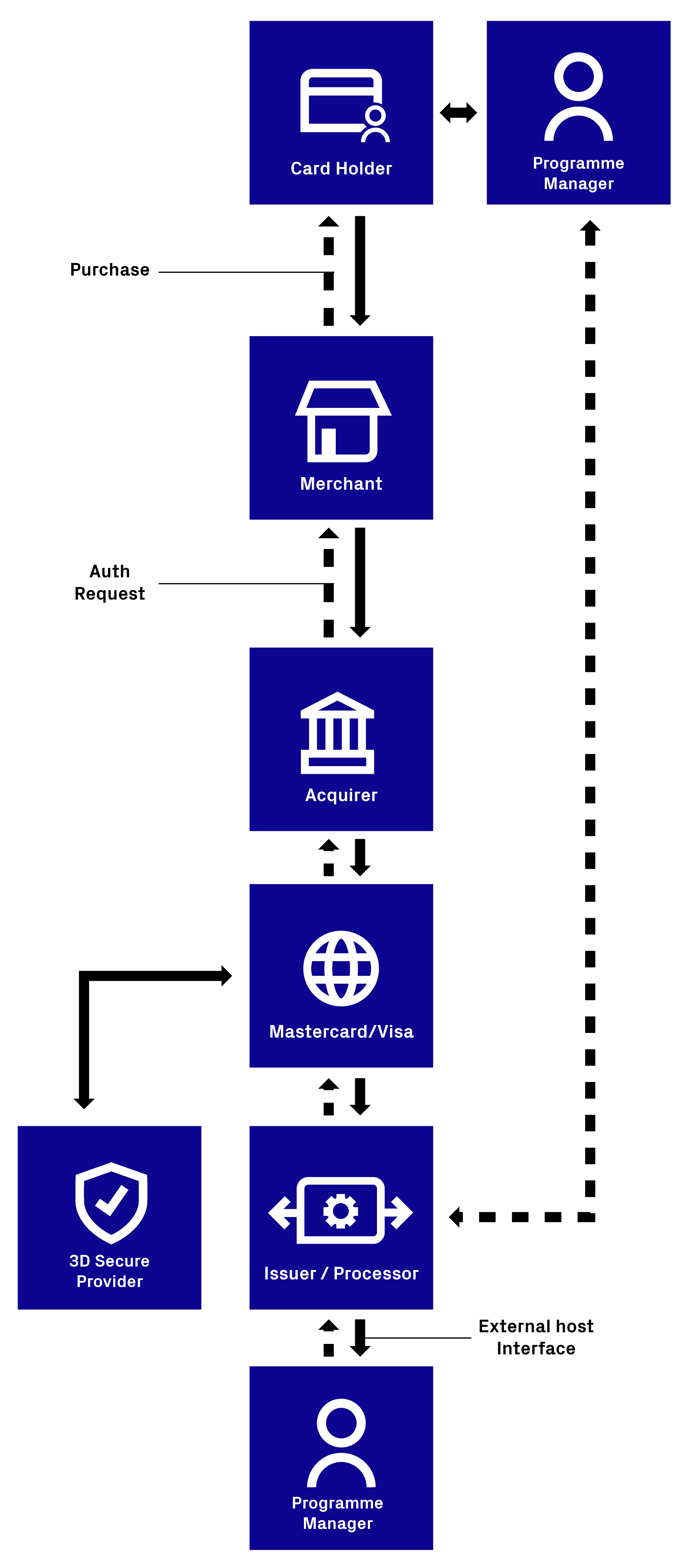

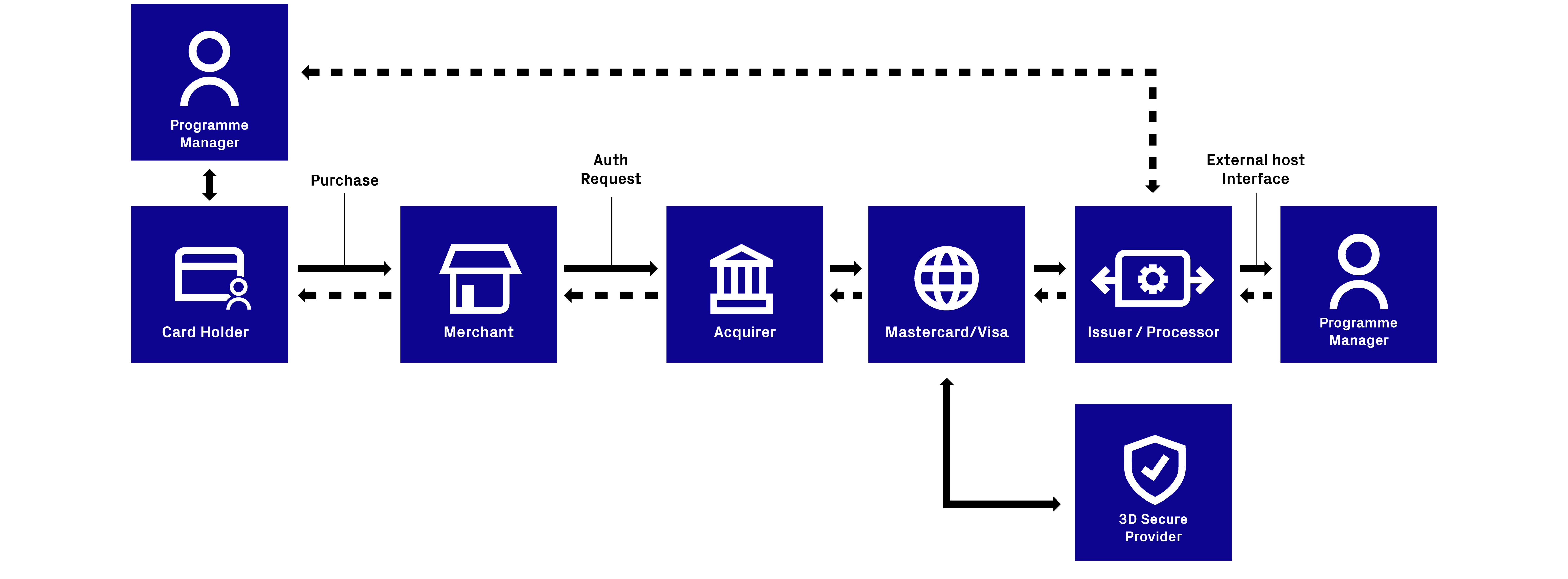

The tap of a debit card only takes a second, but there are multiple cogs whirring behind the scenes before your payment can be completed and approved. The transaction and authorisation process form the heart of the payments industry, and the very fabric of Thredd.

All these entities communicate with each other in a fraction of a second, so you can pay for your coffee or commute without it ever interrupting your day.

The payments ecosystem may look confusing, but we at Thredd are here to help. Our tight-knit partnerships within the network mean we can make the process seamless, and simplify even the knottiest payment problems. Get in touch today to find your fit in the global payments ecosystem.

[1] The chessboard rearranged: rethinking the next moves in global payments

Sign up to receive Industry news, events and insights delivered straight to your inbox.