The Thredd team

December 17, 2025

How embedded, modular credit is redefining the customer experience.

The Thredd team

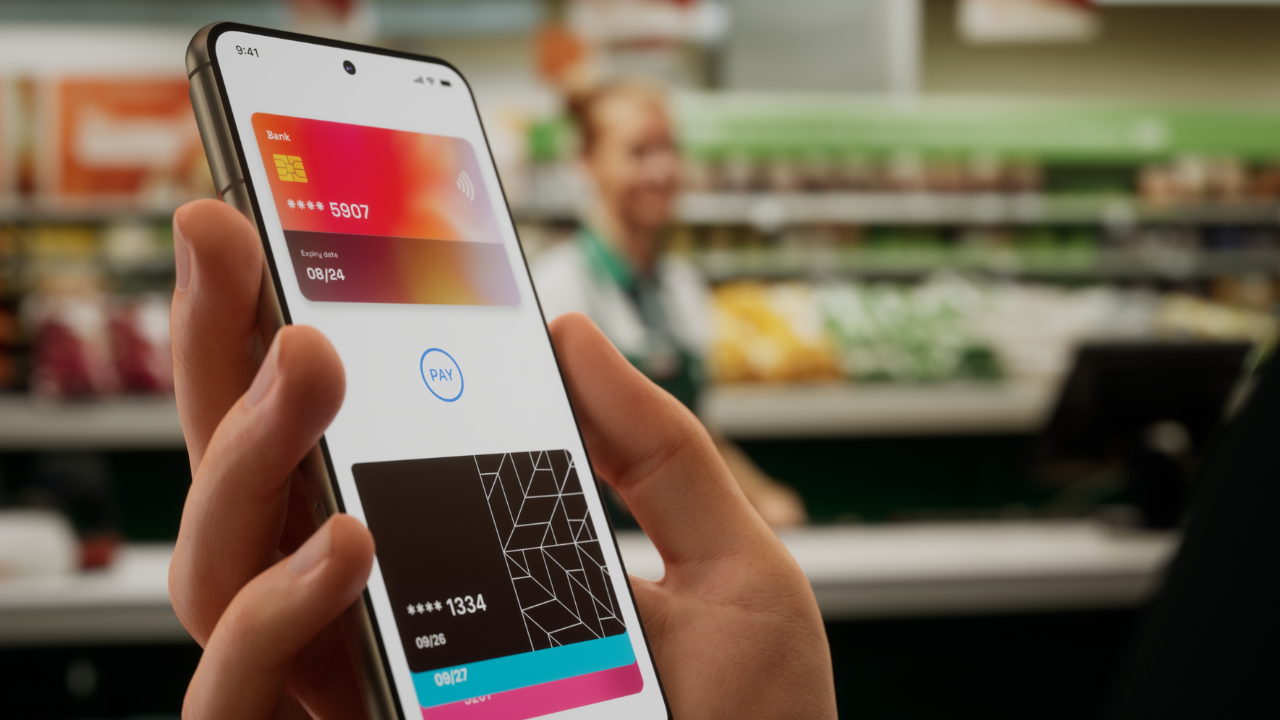

The signals are everywhere. From telecoms to travel apps, consumers expect credit to appear exactly when and where it is needed, not as a separate application or product but as part of a seamless digital journey.

The days of mailing a check or waiting for an approval notice are gone. Modern customers want instant access, flexible repayment, and transparent control within the platforms they already use.

What was once a fixed product, a loan, a line, a card, is being reengineered as a configurable feature embedded into broader digital experiences. The shift from credit as a product to credit as a service marks one of the most important transformations in financial technology today.

As Jonathan Vaux, Head of Propositions and Partnerships at Thredd, puts it:

“Credit is an embedded service that can be deployed in a variety of ways, in service of valuable customer experiences at every stage of a customer’s life.”

Traditional credit programs were rigid and prescriptive. They were built for banks, not for end users. That model is now breaking down under the weight of new behaviors, data, and expectations. Consumers move fluidly between debit, installment, and revolving credit depending on the moment.

They want flexibility and context, and that pattern has fueled the rise of Credit as a Service, or CaaS.

CaaS introduces an API-first infrastructure that allows organizations to embed lending capabilities directly into their platforms without the cost or regulatory complexity of building from scratch. It is a new operating model that treats credit as a flexible, composable element within a broader financial experience rather than a stand-alone product.

This approach also changes how innovation happens. Instead of committing to multi-year builds, fintechs can experiment with a single use case—perhaps post-purchase installments or small business charge cards—measure response, and refine. The ability to test, learn, and iterate has become a competitive advantage in credit. As Vaux notes, “You can start small, learn fast, and scale when you know what works.”

The cohesiveness of what we are doing together in credit is not about a single loan or a single card. It is a feature set that lives within a unified ledger and can scale globally, supporting underserved communities and high-end products alike.

For decades, legacy systems made it nearly impossible to launch multidimensional credit propositions. A product was a product. A loan was separate from a card. Underwriting was isolated from servicing, and every system spoke a different language.

That barrier has fallen. Modern issuer platforms, powered by cloud-native architectures, real-time decisioning, and composable APIs, now allow financial institutions to iterate, test, and scale new credit journeys quickly. The technology no longer limits innovation; it enables it.

What remains is a mindset shift. The institutions that thrive in this new environment will be those that adopt a design-thinking mentality, experimenting, learning, and building around the customer experience rather than the product construct.

Vaux often draws a parallel to the evolution of the telecommunications industry. He recalls that when mobile operators began introducing digital payments and loyalty rewards, customer retention skyrocketed. “They turned a monthly bill into a relationship,” he says. The same logic applies to credit today. The brands that treat credit as a dynamic experience rather than a static product will win the loyalty game.

Artificial intelligence is transforming every layer of the credit lifecycle. Machine learning models are reducing the friction of origination by identifying viable segments and tailoring offers dynamically. AI is helping lenders “weed out the elements that are not essential,” as Taher explains, and focus on the experiences that matter most.

The next wave of AI in credit is not just about faster underwriting; it is about shared intelligence across the financial ecosystem. When credit, fraud, and payments data converge on a unified platform, issuers can identify risk in real time, automate resolution, and continuously refine decisioning models. This makes credit both safer and more dynamic.

Beyond underwriting, intelligent automation is reshaping servicing, collections, and risk management, reducing human intervention, accelerating dispute resolution, and creating predictive, self-learning systems that improve with every transaction.

As Vaux adds, the real power lies in involving the customer in the risk process itself.

“If my card has been used somewhere I do not recognize, I get a notification on my watch. I can act instantly. The customer becomes part of the risk engine.”

AI-driven engagement turns reactive credit management into a proactive, collaborative experience that strengthens both trust and loyalty. The end result is credit that feels conversational rather than transactional.

They have been so underserved, yet they are the most loyal customers once they find someone who understands them.

Embedded credit is fundamentally changing how inclusion is designed.

Instead of fixed, one-size-fits-all products, new modular frameworks allow people to move through flexible “graduation paths” — starting on debit, then earning access to secured and eventually revolving credit. These journeys build trust through behavior, not bureaucracy. As Faran Taher explains, these models “meet customers where they are” and let them build confidence, credit history, and long-term value on their own terms.

This same logic extends to small businesses, which have long been left behind by traditional lenders. For decades, banks viewed the economics of serving small enterprises as unworkable. Yet the loyalty of those customers, once reached, is extraordinary. “They have been so underserved, yet they are the most loyal customers once they find someone who understands them,” says Jonathan Vaux.

Financial institutions must move beyond single-product thinking and design credit around lifelong relationships. The next generation of customers expects personalization, transparency, and the freedom to choose — all delivered through the digital ecosystems they already trust.

As Taher puts it, “People should stop thinking of credit as a product. It’s an embedded service that creates value at every moment of a customer’s life.” Credit is no longer defined by the instrument but by the experience it enables. It lives in the background — intelligent, adaptive, and human by design.

The opportunity ahead is not just technological; it is behavioral.

When credit becomes contextual and personalized, it expands access, rewards responsible actions, and builds lasting loyalty. It transforms what was once a transaction into a relationship. That is how the next generation of financial services will differentiate, retain, and grow in the real-time economy.

Thredd Credit gives innovators the foundation to launch and scale modern credit programs across consumer and small-business segments. Built for speed, flexibility, and compliance, it offers everything needed to bring credit to market faster — from real-time decisioning and configurable underwriting to lifecycle management, payments, and collections.

With regulatory readiness, bureau connectivity, and dispute handling built in, Thredd Credit reduces complexity while giving issuers full control over design, data, and experience. Combined with Thredd’s proven issuer processing stack, it delivers the scalability, security, and intelligence required to power credit for the real-time economy.

Ready to rethink credit?

Explore how Thredd Credit can help you design, test, and launch adaptive credit solutions that scale.

Sign up to receive Industry news, events and insights delivered straight to your inbox.